“We should not set aside the cooperative banks because we all adhere not only to the principles of cooperativism, but also in the banking parameters and guidelines. We have to contribute to the country and to the nation.”

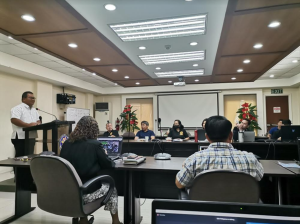

Such is the remarkable statement made by CDA Chairman Undersecretary Joseph B. Encabo during the Cooperative Banks forum held on March 16, 2023 at the CDA Head office in Cubao, Quezon City. The event, held face to face and thru virtual platform, was attended by forty (40) participants from various cooperative banks from Luzon, Visayas and Mindanao, including the CSF personnel. It was facilitated by the Credit Surety Fund (CSF) Service led by Deputy Administrator Atty. Ma. Lourdes P. Pacao as part of the Service’s continuing efforts to enjoin more stakeholders to join the CSF program.

Officers of cooperative banks in attendance came from BANGKOOP, First Isabela Coop Bank (FICO Bank), National Teachers and Employees Cooperative Bank, Ilocos Consolidated Cooperative Bank, One Cooperative Bank and cooperative banks of Cagayan, Zamboanga, Cebu, Benguet, Nueva Vizcaya, Bohol and Zamboanga del Norte. Most of the attendees joined the forum via zoom.

Currently, the Land Bank of the Philippines (LBP) and Development Bank of the Philippines (DBP) are the participating Government Financial Institutions (GFIs) which are contributors to organized CFS Cooperatives (CSFCs) in the country since it was launched by the Bangko Sentral ng Pilipinas (BSP) in 2009. As of March 2023, there are thirty (33) CSFCs registered with CDA since the enactment of Republic Act No. 10744 or the CSF Act of 2015.

Usec. Encabo calls for the cooperative banks’ support to CSF as “cooperative banks must play a very vital role in the development of CSF cooperatives through financial support and portfolio that can be offered to cooperatives, especially to those which belong to the micro and small cooperative sector”.

The CSF is a credit enhancement scheme that provides access to micro small and medium enterprises (MSMEs) including cooperatives that encounter difficulty in obtaining loans from banks due to lack of collaterals and credit history. Participating stakeholders include the local government unit, cooperatives, GFIs, Philguarantee and non-government organizations. CDA regulates and monitors the operations of registered CSFCs and BSP handles the promotion and organization of CSFs.

Service officials Deputy Administrator Ma. Lourdes Pacao, & Technical Assistance Division Chief Recto E. Transfiguracion and BSP Financial Inclusion Manager Eleanor Ramos acted as resource persons who discussed the legal basis of the CSF program with statistics of registered CSFCs, registration requirements and salient features of the CSF program, respectively. Service Acting Director Joselito O. Hallazgo joined the forum via zoom.

The activity was attended physically by Atty. Robin James Gunnacao, President Cooperative Bank of Cagayan, and Mr. Caesar Nomen Flores, Chief Executive Officer and Ms. Cristina M. Salvador, Administrative and Finance Officer both from BANGKOOP.

During the open forum, various comments and queries were raised by participants, among which were : (1) The role and extent of participation of LGU as a partner of CSF; (2) Guarantee and suretyship for loans (3) Liabilities and risks of endorsing cooperatives, the lending bank and the CSF cooperative (3) Interest rate for loans charged to borrowers (4) Possibility of membership of lending banks to more than 1 CSF (5) Investment earnings as a member of a CSF cooperative (6) Qualifications of borrowers and member-endorsers 7) Issues about Directors, Officers, Stockholders & Related Interest (DOSRI) accounts. The resource persons responded to the queries and provided inputs in addition to their respective presentations.

In closing, DA Pacao reiterated the call of Usec. Encabo for cooperative banks to consider CSF as an option to provide opportunities for MSMEs to obtain financing for their businesses through loans guaranteed by a surety cover, financed through pooled funds contributed by the CSFC stakeholders. She echoed the advocacy of CSF’s goal of helping MSMEs succeed.

MARY GRACE I. CINCO

Supervising CDS