The Cooperative Development Authority (CDA), in coordination with the Land Bank of the Philippines (LBP), conducted an online forum on November 4, 2024, bringing together key officers from Credit Surety Fund (CSF) Cooperatives and LBP’s Development Assistance Department (DAD) and Lending Centers. The event aimed to orient and reorient CSFCs and their members, including micro, small, and medium enterprises (MSMEs), on the LBP’s loan application process. Topics included documentary requirements, processing timelines, and common reasons for disapproval. This platform also allowed participants to raise concerns about loan applications directly with LBP representatives, who addressed their queries in real-time.

Assistant Secretary Luz H. Yringco, Board Member III and Head of the Finance Cooperatives Cluster, emphasized in her opening remarks the value of these gatherings in strengthening cooperation and addressing challenges faced by cooperatives. Director Joselito O. Hallazgo, Director of CSF Service, further highlighted the event’s significance in deepening CSF Cooperatives’ understanding of LBP’s loan programs and procedures.

Mr. Crisso Pernito, Head of LBP-DAD, noted that feedback from the forum would help refine the bank’s loan program performance, underscoring the importance of participants’ inputs in enhancing LBP’s services.

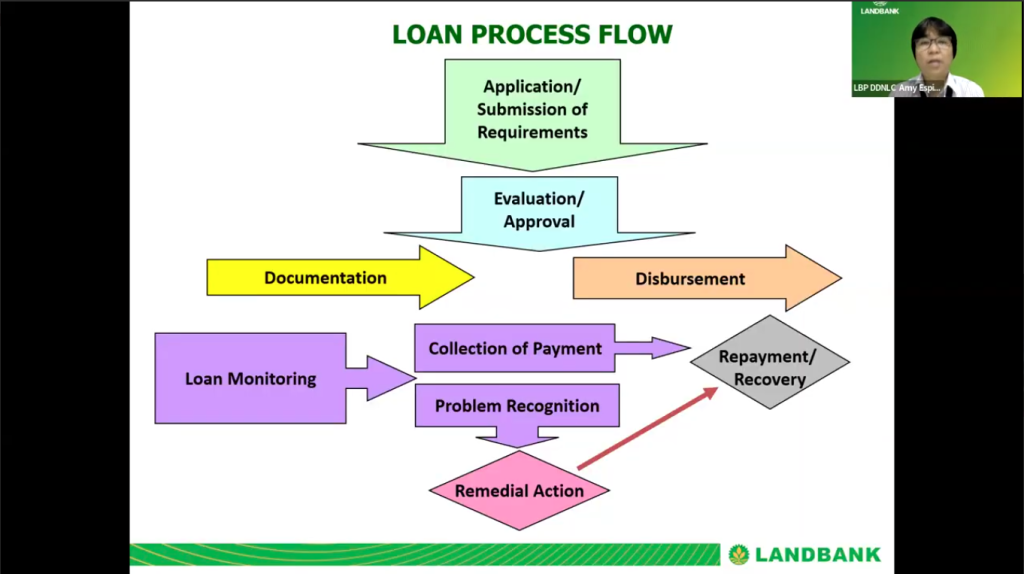

Ms. Amy Espina from the Davao del Norte Lending Center led an in-depth presentation on LBP’s loan application process. Ms. Espina outlined the step-by-step application process, clarified eligibility criteria, and discussed the documentation requirements necessary to facilitate smooth and timely approvals. She also addressed a variety of questions, from interest rates and repayment terms to options for collateral.

The forum effectively addressed participants’ concerns, reduced potential challenges, and offered practical guidance to deepen their understanding of how LBP’s loan services can meet their specific financial needs.

The CDA’s CSF Service reaffirmed its commitment to empowering CSF cooperatives by equipping them with the knowledge and tools necessary to better support MSMEs, thus contributing to the broader goal of financial inclusion and sustainable economic development.