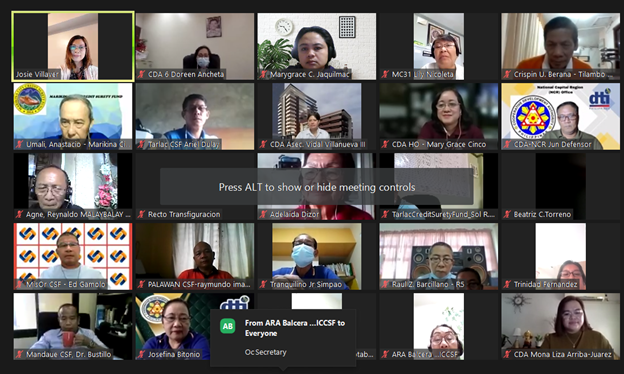

On August 27, 2021, the Credit Surety Fund Service conducted an online consultation via zoom with Credit Surety Funds (CSFs) that are currently facing difficulties in complying with registration requirements. The activity was attended by CSFs’ representatives, CDA key officials, CSF Service personnel, Regional Directors and their respective Senior CDSs. The event was made more significant with the presence of CDA Chairperson, Undersecretary Joseph B. Encabo and Assistant Secretary Vidal D. Villanueva III, Head, Finance Cooperatives Cluster, who collectively expressed full support in the organization of CSFs and in their subsequent registration as cooperatives. Both Usec. Encabo and Asec. Villanueva recognized the important role that CSFs play in enhancing the creditworthiness of micro and small cooperatives thereby giving them access to the credit facility of banks.

The event was facilitated by the Technical Assistance Division of the Credit Surety Fund Service (TAD-CSFS), spearheaded by the Director, Atty. Mona Liza P. Arriba-Juarez and with the TAD Chief, Recto E. Transfiguracion. Presentations and discussions were made on the statistics of CSFs, status of applications and the major issues and concerns on the delay of registration amidst Covid19 pandemic.

In his message, Asec. Villanueva was emphatic in his call to the regional staff to go the extra mile in providing prompt, adequate and efficient assistance to the CSFs which are facing challenges in complying with the registration requirements especially at this time of pandemic. He likewise informed the CSFs on his efforts in closely coordinating with some local Chief Executives such as Mandaue City Mayor, Jonas Cortes, Albay Governor, Al Francis Bichara and Quezon City Mayor, Joy Belmonte, to address certain concerns and got their respective full commitments and support in the establishment of CSFs in their localities.

Some of the issues and concerns raised by CSFs that caused delay in complying with registration requirements are: (1) problems in securing the approval of the Local Chief Executives; (2) non-release of counterpart contributions of other stakeholders; and the (3) series of lockdowns and travel restrictions imposed in various areas of the country.

Director Arriba-Juarez gave significant updates pertaining to CDA’s recent collaborations with its partner agencies resulting to the following; 1) Land Bank of the Philippines’ (LBP) reduction of interest rates on CSF covered loans from 7% to 5% per annum; 2) CDA and Development Bank of the Philippines (DBP) MOA entered into last July 16, 2021 which aims to provide capacity building trainings on financial and operational management, to improve access to financing opportunities, and to create an oversight team to handle CSF-related concerns; and the 3) Philippine Guarantee Corporation’s (PhilGuarantee) release of its contributions to CSFs subject to certain requirements or conditions, which include, among others, the registration of CSFs with the CDA as cooperatives.

The active participation, friendly discussion and accelerated exchange of ideas and inputs were nothing more than a display of vibrant cooperative spirit thus making the online consultation a productive and stimulating activity. /MGCinco