After a three-day workshop to craft the five-year roadmap for the Credit Surety Fund (CSF) Cooperatives for 2024-2028, CSF stakeholders have come up with a solid groundwork that will pave the way for the micro, small, and medium enterprises (MSMEs) to thrive in an era when financial inclusiveness holds the key to economic sustainability.

Held on February 27-29, 2024 at 1CISP in Quezon City, the activity was jointly undertaken by the CDA and the Bangko Sentral ng Pilipinas (BSP) – the program’s implementors – and attended by close to 100 participants composed of officers of twenty-one (21) registered CSF cooperatives, representatives of local government units (LGUs), the Land Bank of the Philippines and BSP. CSF Service Deputy Administrator Atty. Ma. Lourdes P. Pacao and Acting Director Joselito O. Hallazgo led the participants from CDA composed of officers and personnel from the Technical Assistance Division, Inspection and Examination Division, Registration Division, Planning Division, and the CSF section from the regional extension offices. Also present were officers from the BSP, led by Acting Director Mynard Bryan R. Mojica, together with Deputy Director Cesar Augusto E. Villanueva, Jr., Ms. Eleanor D. Ramos, and Ms. Jashzeel F. Baldonado of the Financial Inclusion Office (FIO) and Consultant Mr. Eduardo C. Jimenez.

In his speech, CDA Chair Joseph B. Encabo emphasized the need for the CSF to create opportunities for MSMEs “to make a difference in the life of every ordinary Filipino”, and to constantly innovate, adapt to change, and evolve to address the needs of the changing times.

Assistant Secretary Luz H. Yringco, head of the Finance Cooperatives Cluster expressed full support for the program as a tool that will increase access to finance for small business owners and cooperative members.

BSP acting Director Mojica expressed gratitude to the participants and CDA for their support of the program and gave assurance of the BSP’s commitment through more collaborations in the achievement of the program’s goals and objectives.

CSF Service Deputy Administrator Atty. Pacao presented the national profile and selected statistics of CSF Cooperatives as a prelude to the crafting of the roadmap which aided the participants in setting the direction of the CSF in the next five years.

The workshop was facilitated by Atty. Mickel M. Borigas, a renowned author and international speaker in the fields of finance, governance, and management, among others. Through the SWOT analysis tool, Atty. Borigas enabled the participants to look deeper into the various opportunities and challenges for the CSF co-ops, banking on their values, culture, and strengths. The SWOT outputs were in alignment with the goal of the CSF program of enabling the unbanked MSMEs to be credit-worthy and empowered sector in the financial industry.

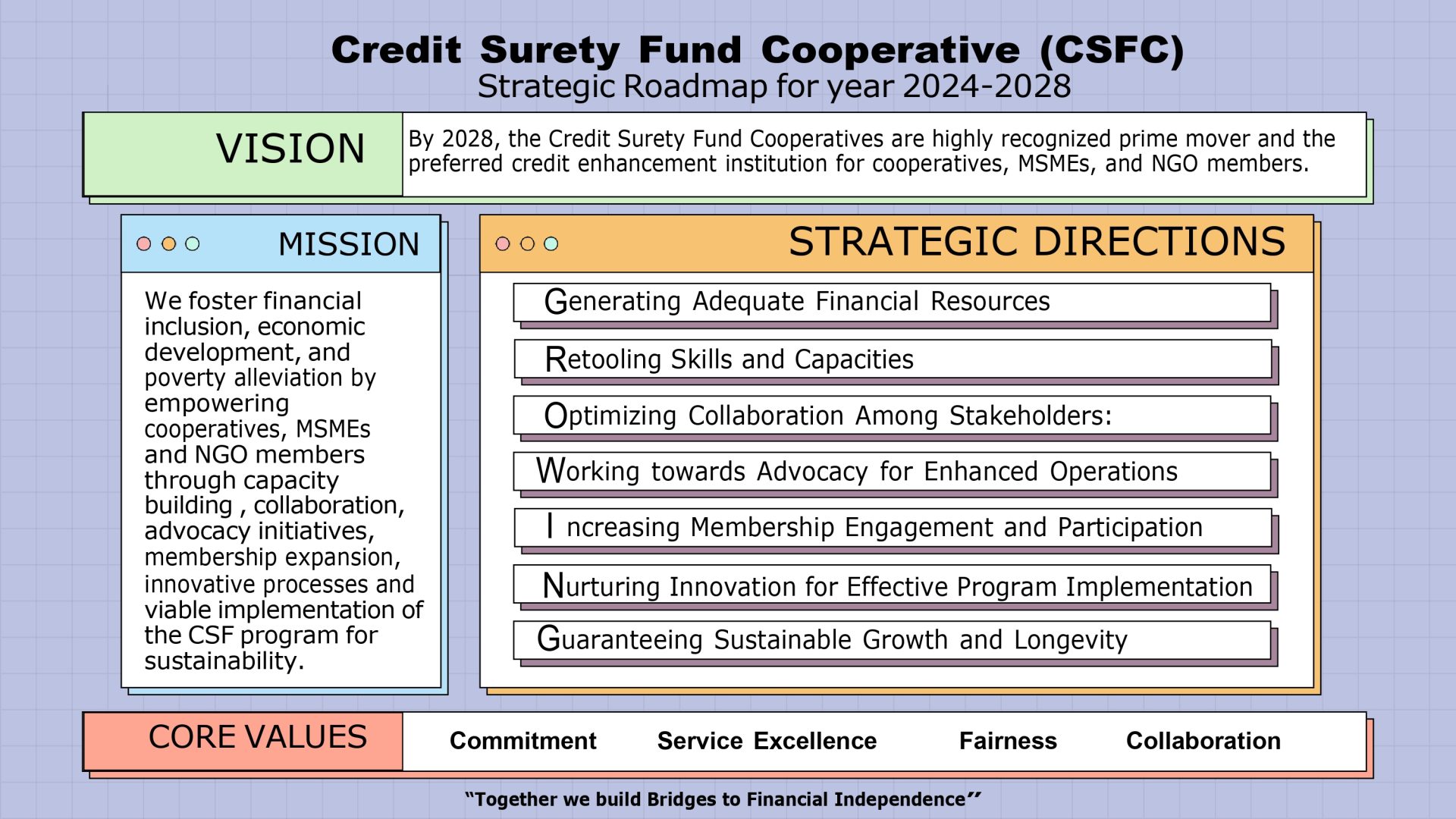

As a result of the workshop, the strategic direction for CSF Cooperatives was envisioned to be GROWING, which stands for – Generating adequate financial resources, Retooling skills and capacities, Optimizing collaboration among stakeholders, Working towards advocacy for enhanced operations, Increasing Membership Engagement and Participation, Nurturing innovation for effective program implementation and Guaranteeing sustainable growth and longevity.

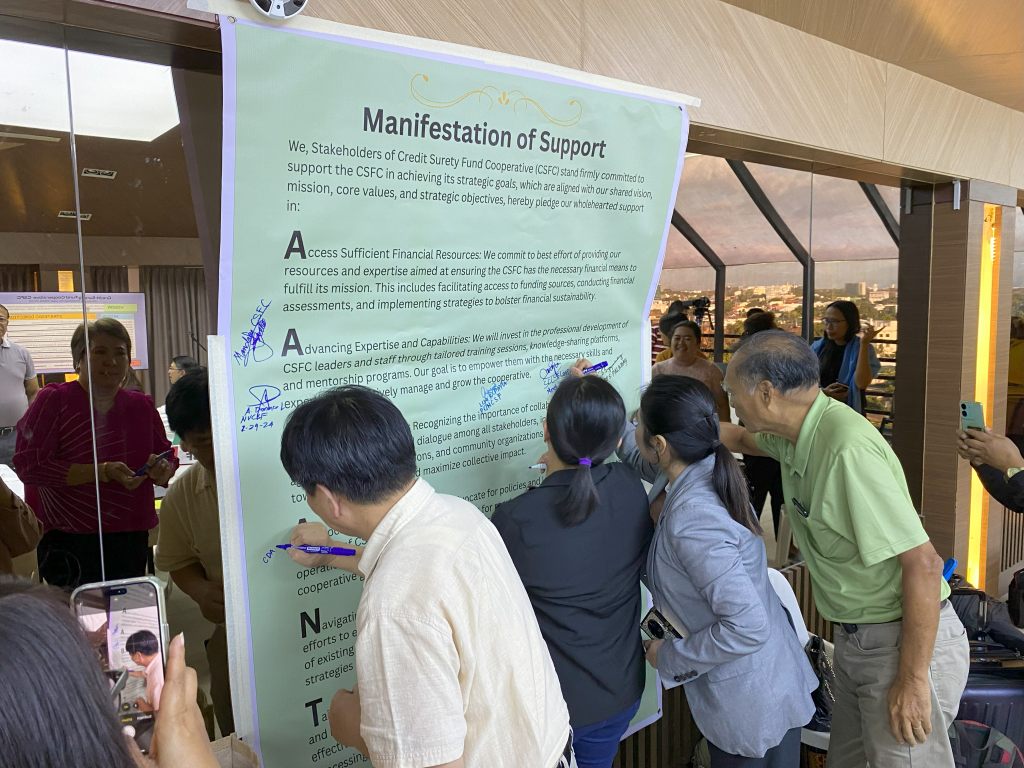

And as a show of support for the five-year roadmap, the participants signed the Manifestation of Support which was summed up in the acronym AABANTE, translating the stakeholders’ overall shared vision, mission, and strategic goals.

With a collective resolve for the CSF Cooperatives to become the “highly recognized prime mover and the preferred credit enhancement institution for cooperatives, MSMEs, and NGO members” that adheres to the core values of Commitment, Service Excellence, Fairness, and Collaboration, the CSF stakeholders together with the CDA and BSP, vowed to work hand in hand to achieve the end goal of the roadmap under the tag line: Together, We Build Bridges to Financial Independence.