The Cooperative Development Authority’s (CDA) Credit Surety Fund (CSF) Service has made significant strides in bolstering the capacity of Credit Surety Fund Cooperatives (CSF Cooperatives) by launching a series of targeted virtual training programs. Understanding the pivotal role of CSF Cooperatives in empowering Micro, Small, and Medium Enterprises (MSMEs), this initiative was designed to enhance their operational effectiveness, improve financial management, and ensure long-term sustainability.

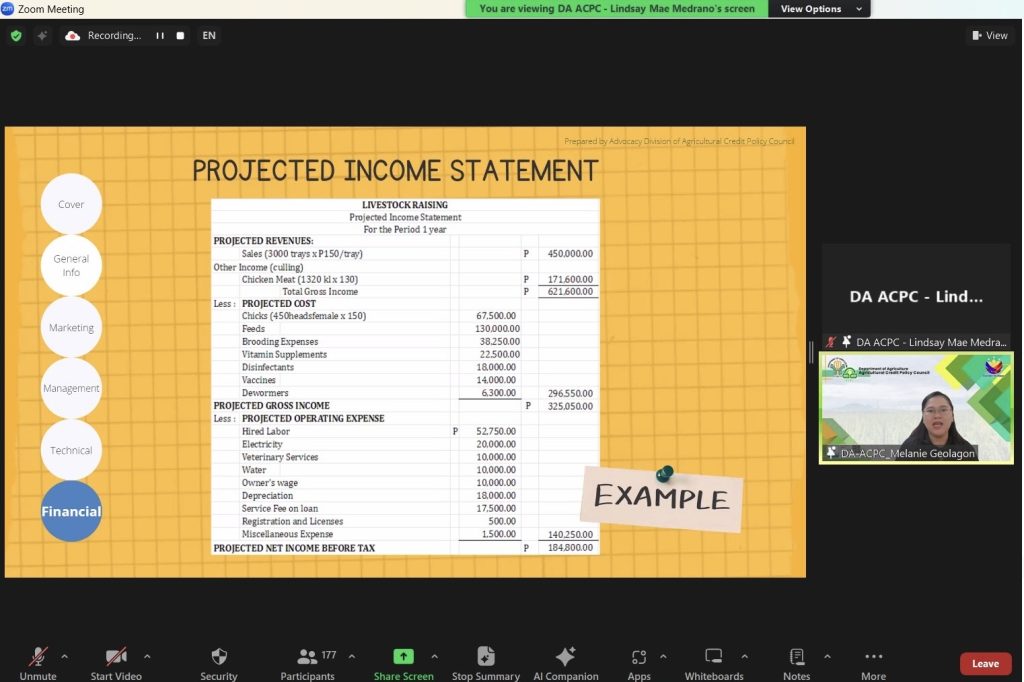

A Business Plan Preparation training was held in collaboration with the Agricultural Credit Policy Council (ACPC), with Ms. Lindsay Mae B. Medrano and Ms. Melanie C. Geolagon as resource persons. This training provided CSF Cooperatives with essential skills for crafting simple, sound, and viable business plans. Key topics included the Framework of Business Planning, Financial Planning, Market Analysis, Risk Management, Monitoring and Evaluation, and Business Plan Preparation.

The training was presented in simple, clear language, ensuring that cooperative members without technical backgrounds could easily understand the concepts and apply them effectively. Equipped with this knowledge, cooperative members are now better positioned to create comprehensive business plans that will enhance their ability to present persuasive loan applications to their chosen lending banks and increase the likelihood of securing loan approvals.

Further, the Land Bank of the Philippines (LBP) Trust Account Department conducted a training on Trust Account Management, offering participants a thorough understanding of trust account principles and regulations. The training covered several key topics: 1. Trust Account Establishment and Maintenance which focused on setting up and managing trust accounts in accordance with regulatory requirements; 2. Other Trust Products and Services which discussed additional investment options for CSF cooperatives, their members, and officers, such as Unit Investment Trust Funds, Personal Equity & Retirement Accounts (PERA), and Investment Management Accounts; 3. Fund Disbursement and Utilization which outlined the process for proper disbursement and use of funds, especially when CSF Cooperatives need to withdraw portions of their deposited funds; 4. Reporting Process which emphasized the importance of maintaining accurate records and submitting required reports from the trustee bank to the CSF Cooperatives; and 5. Risk Management and Control which provided assurance to CSF Cooperatives that the LBP implements effective risk management practices to protect the trust funds.

The training empowered CSF cooperatives with the knowledge and skills necessary to manage their trust accounts effectively, enhance financial security, and make strategic investments.

Giving CSF Cooperatives these important skills and knowledge is crucial because it helps them manage their operations more effectively, make informed financial decisions, and contribute to the growth of local economies. The event, hosted by the Inspection and Examination Division, saw active participation from members and officers of 45 registered CSF Cooperatives across the country, as well as personnel from the CDA CSF Section. The trainings were held on September 26 and October 14, 2024 respectively.

Ms. Melanie C. Geolagon Ms. Melanie C. Geolagon guides the participants through the process of preparing a Projected Income Statement.

Ms. Melanie C. Geolagon Ms. Melanie C. Geolagon guides the participants through the process of preparing a Projected Income Statement.

Ms. Belle Tejerero of the LBP Trust Account Department, presented one of the topics of Trust Account Management