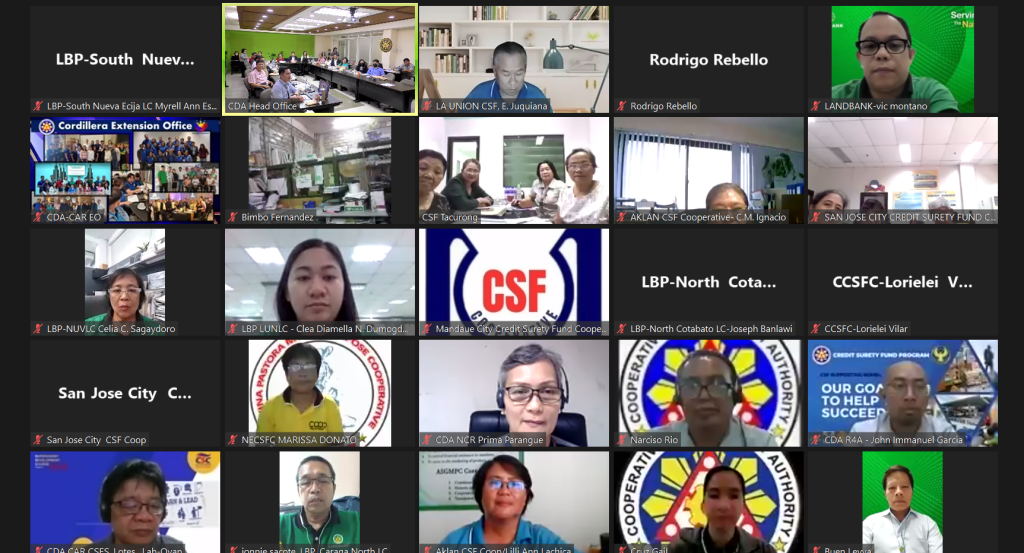

On June 10, 2024, the Cooperative Development Authority (CDA) facilitated a dialogue between the Credit Surety Fund (CSF) Cooperatives and the Lending Program Management Group – Development Assistance Department (DAD) of the Land Bank of the Philippines (LBP) together with its Lending Centers all over the country. Conducted in a hybrid mode, the activity was attended by other key players of the Credit Surety Fund Program, namely, Bangko Sentral ng Pilipinas (BSP) and Local Government Units (LGUs). In total, 130 participants joined this significant event.

The dialogue aimed to facilitate discussion on present challenges involving dealings with LBP and to identify appropriate solutions and interventions toward providing a strategic direction and a conducive environment for CSF cooperatives. The identified challenges, which were the subjects of the discussion, were 1) no special or preferential interest rate provided to CSF Cooperatives; 2) voluminous loan application requirements; 3) slow processing time for loan applications; and 4) default payments of borrowers.

In his message, Asec. Santiago S. Lim, CDA Administrator, through Mr. Edmund Chris Acosido, enjoined the participants to cooperate, collaborate and communicate to harness the full potential of the CSF Cooperatives in empowering cooperative-members and their communities through access to finance. For her part, Asec. Luz H. Yringco, Head of the Finance Cluster, who participated virtually, encouraged everyone to look at this activity through the lens of social responsibility, inclusiveness, true empowerment and economic development of the marginalized sectors through cooperatives.

Mr. Recto E. Transfiguracion, Chief of the Technical Assistance Division, set the tone of the activity by providing the background and rationale of the convergence. Providing further context in the discussion of the challenges confronting the CSF Cooperatives, Ms. Jo Ann C. Gamboa, Chief of the Inspection and Examination Division, presented and discussed the results of the environmental scanning conducted during the crafting of the Five-Year CSF Roadmap 2024-2028, particularly those involving lending banks and how these results affect the realization of the desired objectives contained in the said roadmap. She also presented selected statistics relative to the involvement of LBP in CSF Operations such as contributions made, loan facilitation and past due accounts.

After the discussion of the challenges, the CSF Cooperatives participants were given an equal opportunity to raise their concerns to the DAD-LBP officials and Lending Center representatives. The engagement was fruitful with the valuable sharing of insights, clarifying and resolving issues and setting of commitments.

As most of the challenges were addressed, all stakeholders manifested their continuous support to the CSF Cooperatives and their mission to foster financial inclusion through viable and sustainable implementation of the Credit Surety Fund (CSF) program:

- BSP shall continue to provide a capability enhancement program to improve the internal capacity of the CSF Cooperatives in the areas of credit, financial management, entrepreneurship and risk management, among others;

- LGUs shall continue to provide additional contributions and support to CSF Cooperatives through the provision of facilities, staff, administrative/operating funds, and trainings;

- LBP shall propose a special program to the LBP Board which shall lower interest rates of loans to be availed of by cooperative/MSME borrowers and simplified loan procedures; and

- CSF Cooperatives have committed to strengthen their institutional capacity including governance structures, operational efficiency, and financial management practices. They shall likewise continue to observe prudential standards prescribed under the IRR of RA 10744 to safeguard the fund of the cooperative.

The newly designated Deputy Administrator of the CSF Service, Atty. Elizabeth O. Batonan expressed her appreciation to all stakeholders for the productive results of the dialogue. She underscored that lending banks such as the LBP are invaluable components of the entire ecosystem of CSF. She further articulated that with the growing need for affordable credit and financial products and services, the CSF Cooperatives, in fulfillment of their social mission, need LBP’s support and involvement in the program more than ever. She also mentioned endeavors of the government to enhance the credit flows to the rural areas and achieve a more inclusive financial system through the expansion of the reach and accessibility of the CSF program to more provinces and cities in the country. Particularly to the unserved, underserved and marginalized communities, including micro, small, and medium enterprises (MSMEs), farmers, fisherfolks, women entrepreneurs, and cooperatives in rural areas. The Cooperative Development Authority, together with BSP, LBP and LGUs, shall continue advancing the aspirations of the CSF Cooperatives.