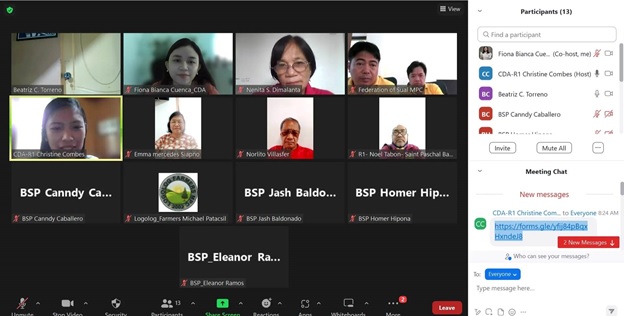

On April 4, 2023, the Credit Surety Fund Section (CSFS) of the Cooperative Development Authority (CDA) Regional Extension Office I together with the Bangko Sentral ng Pilipinas (BSP) personnel conducted a Contributors Orientation Seminar (COS) for the additional members of Pangasinan Credit Surety Fund via Zoom platform. This is in compliance with one of the requirements needed in admitting new members to the organization.

Mr. Homer Hipona from the Financial Inclusion Office of BSP clearly presented the CSF introduction, concepts, programs, services, and benefits to possible coop members. Some of the topics discussed were the following: background on the CSF Act, the legal basis for the creation of CSF cooperatives, salient features of RA No. 10744, how to create CSF cooperative, who can join the CSF Cooperative, the process of borrowing thru CSF, capability enhancement programs by BSP, and benefits of the CFS to coops/ MSMEs and LGUs.

Important Notes to Remember:

- Republic Act No. 10744 or “Credit Surety Fund Cooperative Act of 2015” – enacted into law on February 6, 2016; An Act providing for the creation and organization of CSF cooperatives to manage and administer credit surety funds to enhance the accessibility of micro, small and medium enterprises (MSMEs), cooperatives and non-government organizations (NGOs) to the credit facility of banks and for other purposes.

- Credit Surety Fund- Credit enhancement facility that aims to increase the creditworthiness of MSMEs which are experiencing difficulty in obtaining loans from banks due to a lack of acceptable collateral, capacity, and credit history.

- Credit Surety Fund Cooperative – LGU-partnered cooperative comprised of well-capitalized and well-managed cooperatives/NGOs, Local Government Unit (LGU), Government Financial Institutions (GFIs), IGLF, and Government Agencies (GAs), which will enable the MSMEs, cooperatives, and NGOs to have easier access to credit from banks despite the lack of collateral

- Benefits of the CSF to Coops/MSMEs

- Easier access to credit from banks

- Increases net worth due to increase in membership

- Increases income due to service fees collected

- Improves credit management and marketing skills through the capability enhancement program of the CSF

In addition, the cooperative members participated well in the orientation webinar. During the open forum, Ms. Ellen Ramos of BSP and Ms. Bianca Cuenca of CDA diligently answered the queries.

In the end, Ms. Emma Mercedes Siapno, the Chairperson of Pangasinan Credit Surety Fund appreciated the usual support of the CDA and BSP personnel in the on-going registration process of their organization in becoming Pangasinan Credit Surety Fund Cooperative.

(Bianca Cuenca, Acting Head, CSF Section)