The Philippine economy is built on micro, small, and medium-sized businesses, as well as cooperatives. One factor impeding the growth of these businesses is their inability to obtain financing from banks and other financial institutions. This paved the way for the establishment of the Credit Surety Fund (CSF) to assist these businesses, cooperatives, and other organizations in establishing creditworthiness and bankability.

The CSF Section of Cooperative Development Authority Region I Extension Office (CDA R1 EO) spearheaded the Koop Balitaan webinar entitled CSF Programs and Services on July 7 and August 4, 2022. This serves as an avenue to feature CSF concepts, programs, and services pursuant to RA No. 10744 or the CSF Cooperative Act of 2015 to all the potential CSF coop members in Region I. The said webinar was attended by two hundred eighteen (218) participants through Koop Balitaan in Zoom Meeting and CDA Region I Extension Office Facebook Live.

It started at 9:30 a.m. with an opening prayer, followed by the singing of the national anthem and the Region 1 Hymn, and the recitation of the Cooperative Pledge.

Acting Regional Director Alberto Sabarias welcomed the cooperatives, guests, and participants in his opening remarks. He also briefly explained the concepts and benefits of CSF programs and services. Immediately thereafter, the emcee, CDS I Christine Joy Combes briefly introduced the speaker prior to the lecture proper.

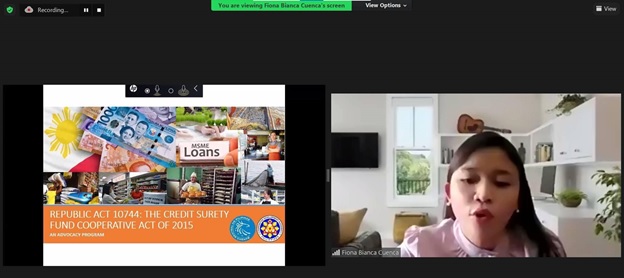

The Acting Chief of CSF Section CDA Region I EO, Ms. Bianca Cuenca clearly presented the CSF introduction, concepts, programs, services, and benefits to possible coop members. Some of the topics discussed were the following: background on the CSF Act, the legal basis for the creation of CSF cooperatives, salient features of RA No. 10744, how to create CSF cooperative, who can join the CSF Cooperative, the process of borrowing thru CSF, capability enhancement programs by Bangko Sentral ng Pilipinas, and benefits of the CFS to coops/ MSMEs and LGUs.

Important Notes to Remember:

- Republic Act No. 10744 or “Credit Surety Fund Cooperative Act of 2015” – enacted into law on February 6, 2016; An Act providing for the creation and organization of CSF cooperatives to manage and administer credit surety funds to enhance the accessibility of micro, small and medium enterprises (MSMEs), cooperatives and non-government organizations (NGOs) to the credit facility of banks and for other purposes.

- Credit Surety Fund- Credit enhancement facility that aims to increase the creditworthiness of MSMEs which are experiencing difficulty in obtaining loans from banks due to a lack of acceptable collateral, capacity, and credit history.

- Credit Surety Fund Cooperative – LGU-partnered cooperative comprised of well-capitalized and well-managed cooperatives/NGOs, Local Government Unit (LGU), Government Financial Institutions (GFIs), IGLF, and Government Agencies (GAs), which will enable the MSMEs, cooperatives, and NGOs to have easier access to credit from banks despite the lack of collateral

- Benefits of the CSF to Coops/MSMEs

- Easier access to credit from banks

- Increases net worth due to increase in membership

- Increases income due to service fees collected

- Improves credit management and marketing skills through the capability enhancement program of the CSF

The Deputy Administrator of CSF Department, Atty. Ma. Lourdes P. Pacao also graced the said webinar. She further stressed the importance of empowering enterprises and cooperatives thru the help of the Credit Surety Fund. She reiterated that Region I has one registered CSF cooperative which is La Union Credit Surety Fund Cooperative (LUCSFC) as to date. She encouraged the participants to participate in the creation of CSF cooperatives in Region I for them to grow more sustainably and efficiently.

In addition, the cooperative leaders participated well in the orientation webinar. During the open forum, Atty. Pacao and Ms. Cuenca diligently answered the queries.

After two (2) hours of discussion, a certificate was presented to Ms. Cuenca in appreciation of her invaluable effort and service as Resource Speaker. Finally, Acting Supervising CDS Edilberto Unson conveyed her Closing Remarks through inspirational quote that will truly motivate the cooperatives to engage more in several activities, programs and trainings of CDA Region I EO.

(Fiona Bianca R. Cuenca, Acting Chief, CSF Section)