ACCELERATING ACCESS TO FINANCE THROUGH CREDIT SURETY FUND

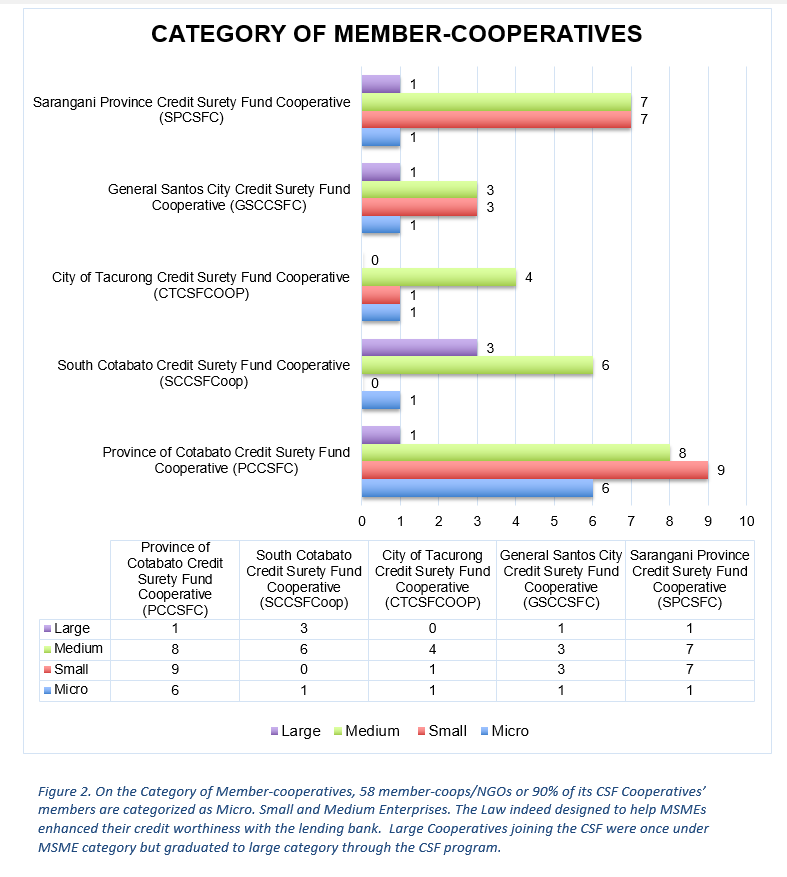

The Credit Surety Fund (CSF) Cooperative is an LGU-partnered cooperative composed of well-capitalized and well-managed cooperatives, non-government organizations, Local Government Unit (LGUs), Government Financial Institutions (GFIs), the Philippine Guaranty Corporation (formerly the Industrial Loan Guaranty Fund), and government Agencies. These enables the micro, small, and medium enterprises (MSMEs), cooperatives, and NGOs to have easier access to credit from banks despite a lack of collateral.

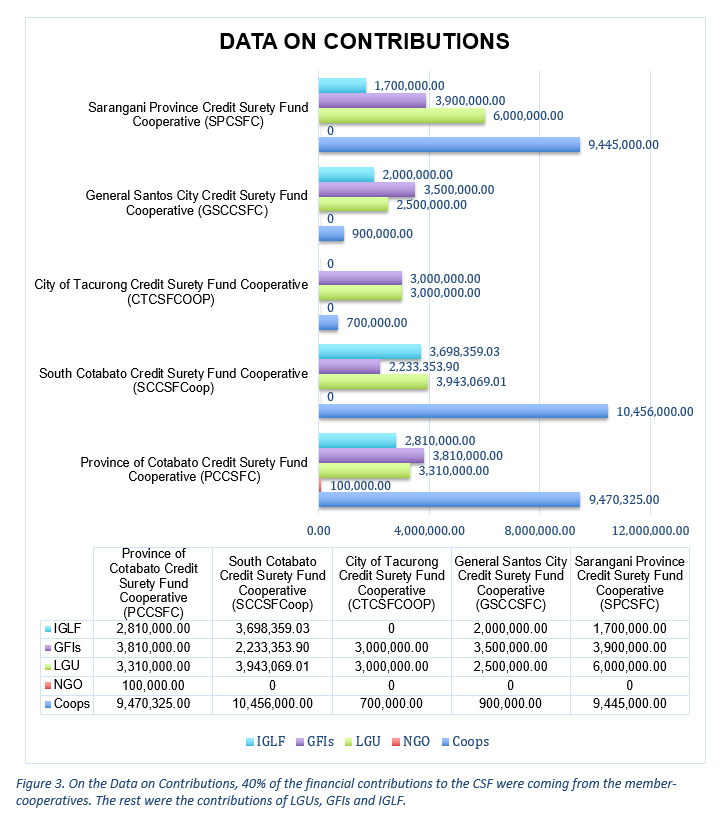

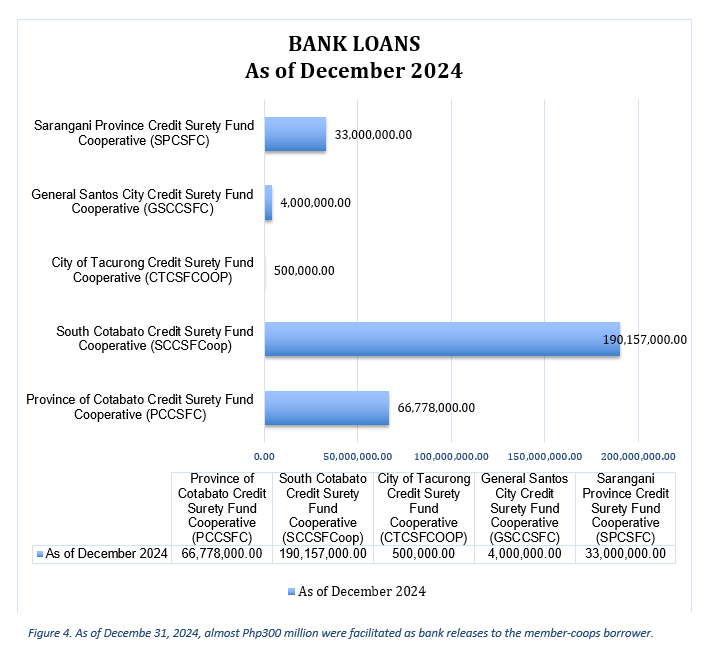

With the organization of CSF Cooperatives, the credit surety fund generated from the contributions of member cooperatives, NGOs, LGUs, GFIs, and Phil Guaranty Corp will now serve as security for the loans obtained by qualified borrowers from lending banks through the surety cover issued by the Board of Directors of the CSF Cooperative. Through this CSF program, MSMEs and cooperatives can now avail loans from banks without the need for hard collateral.

CSF Cooperative can only be organized one per province and city; hence, Local Government Unit plays vital role in the CSF program since no CSF cooperative can be established and registered with CDA without the involvement and financial support from the LGU.

The CSF benefits is not only limited in providing members of good standing access to bank credit but also increasing net worth due to an increase in membership, increasing income due to surety fees collected, and improving the coop’s credit management and marketing skills through the training program component of CSF spearheaded by the Bangko Sentral ng Pilipinas (BSP).

CSF is not only advantageous to the member-cooperatives but also to the LGU as it will not only support the program of the LGU on poverty alleviation but also increases its economic activities, job generation and non-susceptibility to high costs of borrowings (i.e., unlike 5-6 and loan sharks). CSF also help constituents by providing access to bank credits without the need for hard collateral.

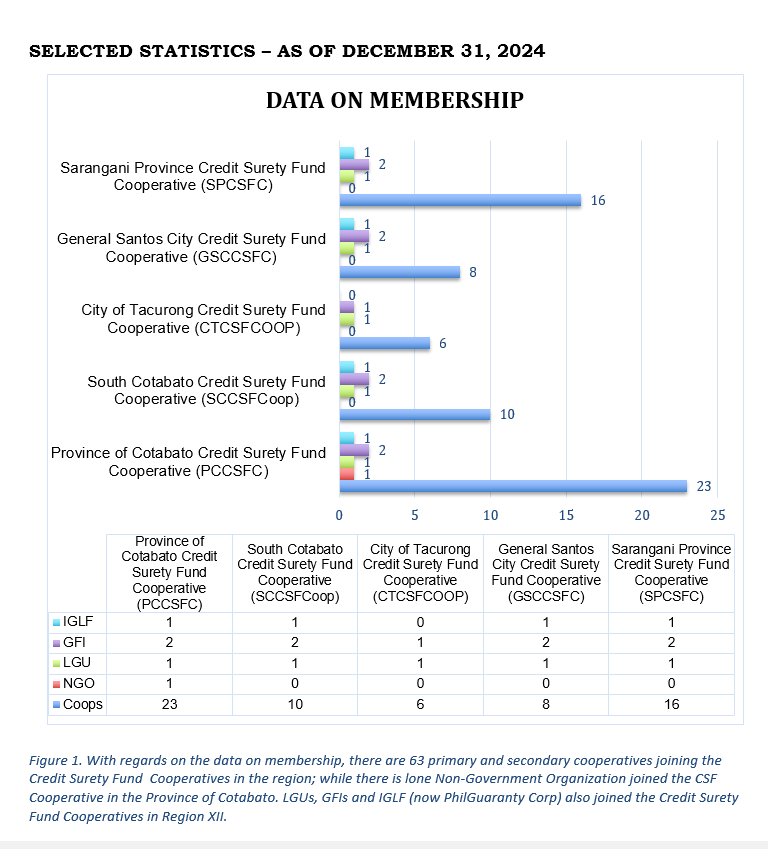

In order to strengthen the framework on accelerating access to finance and establish a sustainable Credit Surety Fund cooperatives that will benefit the entire region, CDA maintain its close coordination with the local government officials and cooperatives. Evident to this, Region XII (SOCCSKSARGEN) has now five (5) registered Credit Surety Fund Cooperatives:

- Province of Cotabato Credit Surety Fund Cooperative (PCCSFC);

- South Cotabato Credit Surety Fund Cooperative (SCCSFCoop);

- Sarangani Province Credit Surety Fund Cooperative (SCCSFC);

- General Santos City Credit Surety Fund Cooperative (GSCCSFC); and,

- City of Tacurong Credit Surety Fund Cooperative (CTCSFCOOP).