by: ROMA A. BELANO, CDS II

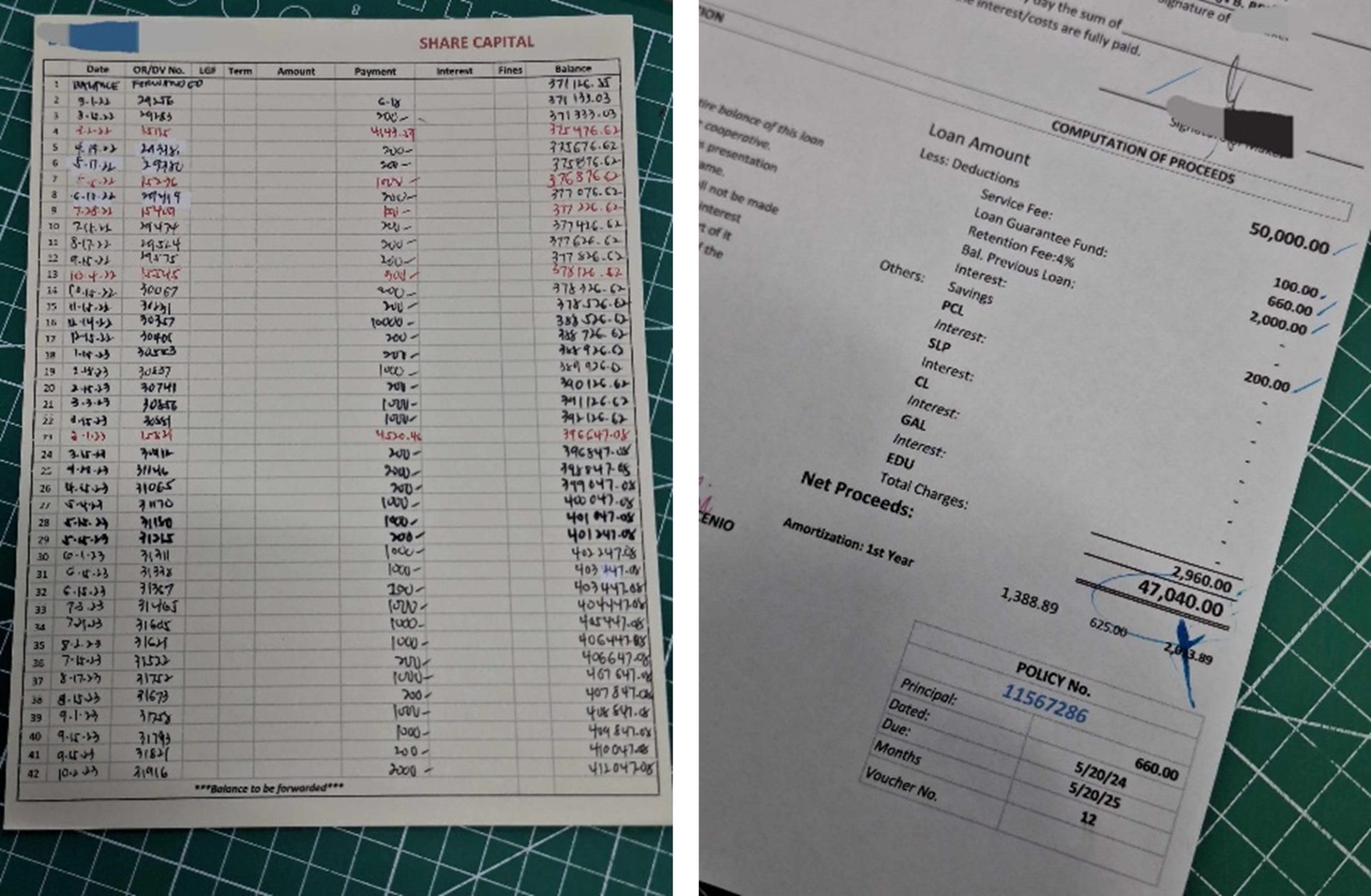

Cooperatives are self-help organizations. This is one of the noted cooperative values which separates cooperatives from other forms of organizations. This enables the Baao Municipal Officials and Employees Credit Cooperative (BMOEC) to sufficiently provide the needs of their members in terms of loans, through implementation of an effective capital build-up program. First, members are required to pay a minimum of P200 monthly charged against their salaries. But some of the members give more which ranges from 200, 300, 500 and even thousands. Second, the cooperative deducts a certain percentage as retention which adds up to the borrower’s capital which follows this schedule:

Share Capital Retention for Regular Loan:

| Loan Amount (Php) | Retention (CBU) |

| Above 250,000 | 1% |

| 100,001-250,000 | 2% |

| 50,001-100,000 | 3% |

| 25,001-50,000 | 4% |

| Below 25,000 | 5% |

Apart from the former, an amount of P200 is also credited to savings deposits of the member which earns 1% per annum. Third, a retention of 1% is added to members’ capital under its Special Lending Program which include Emergency Loan, Petty Cash Loan, Gadget/Appliance Loan, Educational Loan or Midyear and Year-end Bonus Loan. As means to ensure capital generation, members with less than 50,000.00 paid-up capital share are required to retain 50% of their annual interest on share capital and patronage refund. On the other hand, those with at least 50,000.00 paid-up share capital are only required to retain 25% of their annual interest on share capital and patronage refund.

Apart from the former, an amount of P200 is also credited to savings deposits of the member which earns 1% per annum. Third, a retention of 1% is added to members’ capital under its Special Lending Program which include Emergency Loan, Petty Cash Loan, Gadget/Appliance Loan, Educational Loan or Midyear and Year-end Bonus Loan. As means to ensure capital generation, members with less than 50,000.00 paid-up capital share are required to retain 50% of their annual interest on share capital and patronage refund. On the other hand, those with at least 50,000.00 paid-up share capital are only required to retain 25% of their annual interest on share capital and patronage refund.Aside from these initiatives, the BMOEC also conducts the Annual Share Capital Pa-Raffle which significantly contributed to the capital generation of the cooperative. This endeavor also replenishes capital withdrawals of retired and transferred members of the coop. With this raffle program, the cooperative had generated capital of P623,000 in 2021; P653,500 in 2022; and P245,200 in 2023. As of December 31, 2023, BMOEC has a total of P11,104,779.36 paid-up share capital and P1,957,252.94 savings deposits. This proves that cooperation creates wonders. As what the line in the Cooperative Pledge goes…”Alone, I am Weak but with Others I am Strong.” A true manifestation that collective efforts of the members does not only lead to building capital but as well as building a self-sufficient organization.

This proves that cooperation creates wonders. As what the line in the Cooperative Pledge goes…”Alone, I am Weak but with Others I am Strong.” A true manifestation that collective efforts of the members does not only lead to building capital but as well as building a self-sufficient organization.