Thanks to the strong partnership between the Cooperative Development Authority – Cordillera Administrative Region Extension Office (CDA-CAR EO), particularly the Credit Surety Fund Section (CSFS) led by Senior Cooperatives Development Specialist Mr. Lotes P. Lab-oyan, PhD., and Radyo Pilipinas Dagupan, headed by Station Manager Ms. Maricel Fronda, PhD., a successful media campaign was launched on June 26, 2025, to raise awareness and promote the Credit Surety Fund (CSF) Program. This initiative aimed to bring the benefits of the CSF Program closer to micro, small, and medium enterprises (MSMEs), cooperatives, and local government units (LGUs), empowering them through improved access to credit and financial services.

Many MSMEs and cooperatives continue to struggle in securing affordable loans from traditional banks. This is often due to lack of collateral, limited credit history, or high perceived risks by lenders. The CSF Program was designed to address these issues by providing a credit enhancement mechanism—essentially a guarantee—that bridges the gap between borrowers and financial institutions. Through the CSF program, MSMEs and cooperatives can now access much-needed capital without the usual barriers.

At the heart of the CSF Program is a fund pooled from contributions by member cooperatives, NGOs, LGUs, and other stakeholders. This fund acts as a security or surety cover for loans availed by qualified borrowers. Lending institutions, in turn, recognize this surety as collateral, allowing them to extend credit more confidently.

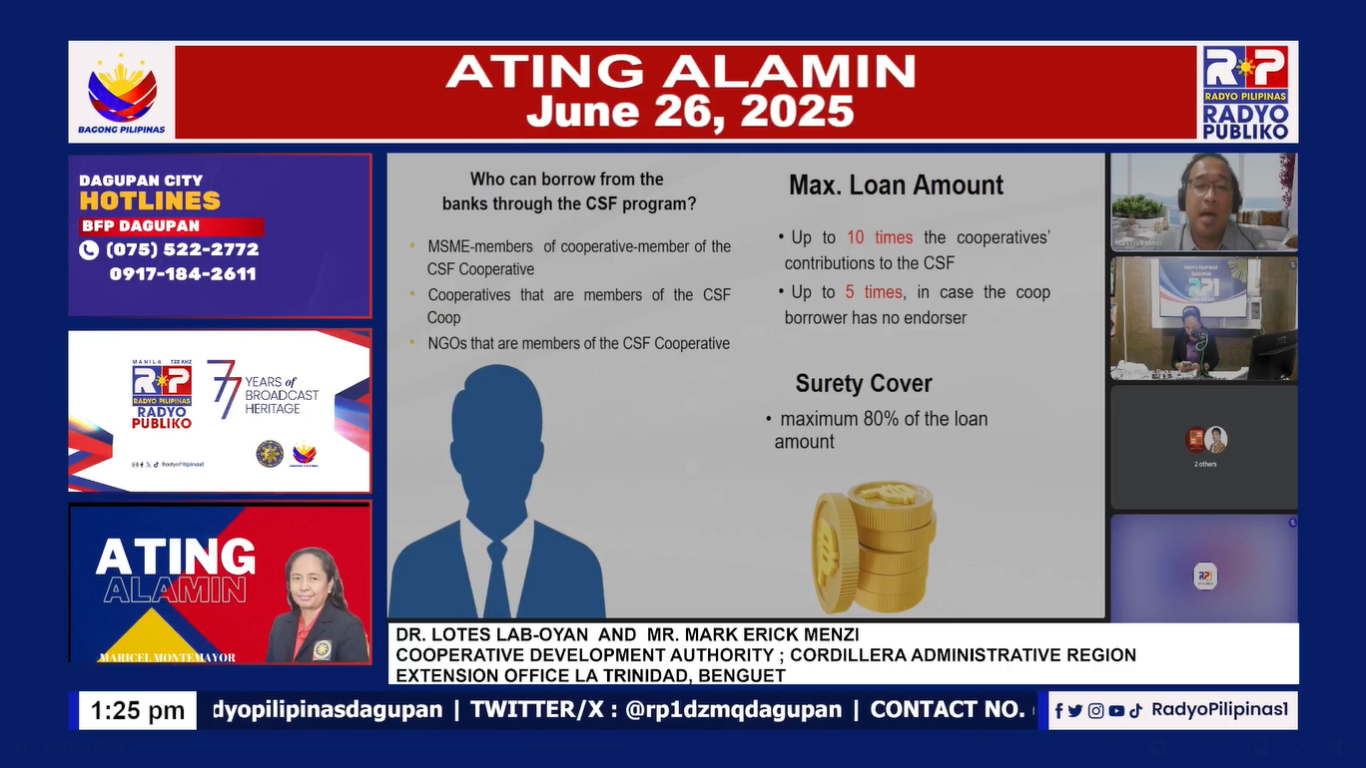

Among the key features discussed during the media campaign were:

- Surety Cover: Up to 80% of the loan amount can be covered through CSF.

- Loan Limits: Borrowers can avail of loans up to 10 times their cooperative’s contribution to the fund, or up to 5 times without an endorser.

- Eligible Loan Purposes: These include working capital, equipment acquisition, purchase of goods, agricultural inputs, and other economic or livelihood-generating activities.

The CSF Program is not just limited to MSMEs – it creates opportunities for a wide range of stakeholders:

- MSMEs

- Easier access to bank credit

- Protection from predatory lending (e.g., “5-6” schemes and loan sharks)

- Increased potential for income and patronage refunds

- Cooperatives and NGOs

- Enhanced access to bank financing for programs and services

- Increased net worth and membership base

- Income generated from trust funds

- Capability-building support to improve credit and marketing operations

- Support for MSME members within the cooperative

- LGUs

- Promotion of financial inclusion at the grassroots level

- Higher credit access for constituents

- Potential for increased local revenue

- Strategic support to poverty alleviation initiatives

To date, there are already 46 CSF Cooperatives established across the country, actively supporting the growth of local enterprises and communities.

When asked about the challenges of the program and how it could be further promoted, the section acknowledged its limitations in manpower. However, Mr. Lab-oyan, emphasized, “Hindi lang po kami tatatlo sa opisina (We’re not just three people in the office).” He also highlighted the importance of strong partnerships in expanding the program’s reach. “With the support of local government units, cooperative development officers, unions and federations, other government agencies — particularly the Bangko Sentral ng Pilipinas (BSP) and the Land Bank of the Philippines (LBP) — and of course, our media partners, we believe we can introduce the CSF Program to more cooperatives and communities across the country,” he shared.

‘Tiwala lang at para sa bayan,’ one staff remarked. ‘We work with trust and a deep sense of public service. People are at the center of development, which is why we take a grassroots approach in engaging with communities to ensure the success of this program.’

The collaboration between CDA-CAR and Radyo Pilipinas Dagupan proves that with the right platform and partners, transformative programs like CSF program can reach and benefit more Filipinos. As the CSF Program continues to grow, it stands as a powerful tool in empowering cooperatives, uplifting MSMEs, and strengthening the country’s financial inclusion efforts.

To view the full interview, kindly click this link: https://tinyurl.com/CSFPrograminterview