Upon the registration of the Benguet Credit Surety Fund Cooperative (BCSFC) in December 20, 2019 in compliance with Republic Act 10744, eighteen (18) member-cooperatives, the Provincial Government of Benguet, the Land Bank of the Philippines, the Development Bank of the Philippines, and the Philippine Guarantee Corporation (previously known as the Industrial Guarantee and Loan Fund) pooled financial resources to create the Surety Fund for the BCSFC. This Surety Fund serves as the security for loans obtained by qualified borrowers from lending banks in the form of surety cover.

Among the member cooperatives of the BCSFC, Hi-Land Farmers’ Multipurpose Cooperative (previously known as Benguet Farmers’ Multipurpose Cooperative) has the highest investment and at the same time, serves as one of its most active borrowers. This asserts Hi-Land Farmers’ Multipurpose Cooperative as a significant partner of BCSFC in fulfilling its mandate of facilitating members to avail of collateral-free loans.

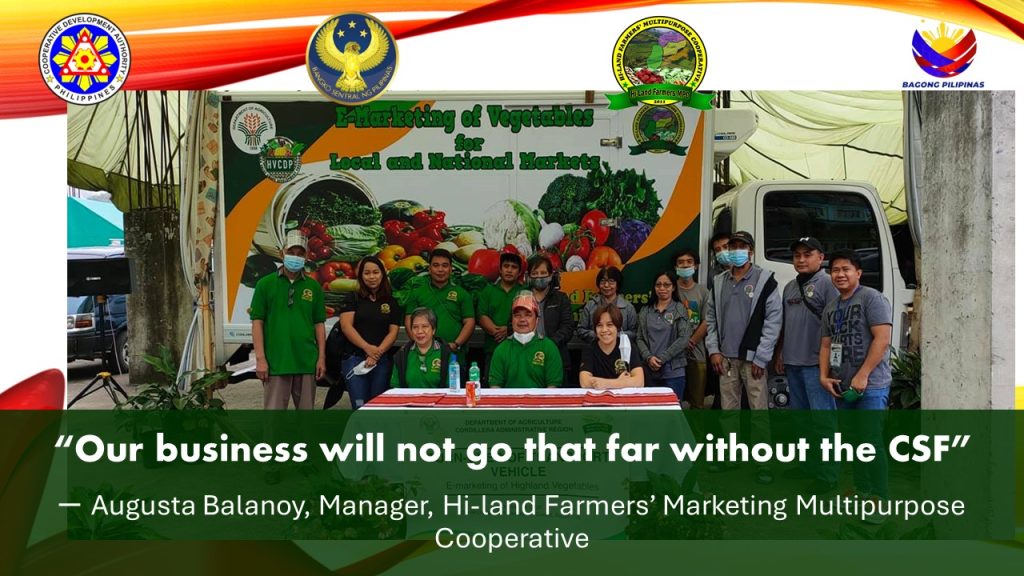

With its operations primarily anchored on agriculture, Hi-Land Farmers’ MPC adopts and implements various strategies for agricultural products to reach the tables of Filipino households. Through grants from the Department of Agriculture and augmented by its own resources, the cooperative was able to procure a Refrigerated Cold Truck and a Ten (10) Wheeler Truck used in the marketing of vegetables to local and national markets. Also, to add to its existing marketing network and linkages, the cooperative is in talks with several E-marketing firms to develop a system akin to famous online shopping apps that would facilitate easier access of fresh vegetables to consumers. These, along with other business expansions, have placed the cooperative as one of the leading agricultural cooperatives in the region and aids in the realization of its mission of “developing a flexible and farmer-empowering cooperative through employment of a system that shall encompass all aspects of the agricultural industry cycle from production to marketing.”

In its journey to attain these milestones, Hi-Land Farmers’ MPC employed various measures to sustain and expand its operations. Initially offering marketing services, the cooperative decided to offer savings and credit services to its members. To aid this operation, the cooperative was able to secure 635,000-peso grant from the Department of Labor and Employment in 2016 that was utilized for agricultural loans of its members. With 80% of its membership comprised of small-scale farmers, the cooperative felt the need for additional capitalization. Thus, it secured a loan from the Landbank of the Philippines through the Benguet Credit Surety Fund Cooperative which augmented its capital used for reloaning to members and its staff.

“Our business will not go that far without the CSF.” This is how Ms. Augusta Balanoy, Manager of the Hi-land Farmers’ Multipurpose Cooperative, described the CSF complemented their existing business operations. With the aid of the CSF loan, Hi-Land Farmers’ MPC was able to split resources for its operations. Borrowings through the CSF are used solely for its credit operations while revenue generated are being utilized for its other business activities as well as business improvements especially with its upcoming big item projects requiring large capital outlay. The loan availed through the BCSFC was valuable especially during the pandemic when many businesses ceased operations. The cooperative received additional loan requests from affected members. These were then granted to help them recover from the effects of the pandemic. This shows how the CSF has complemented Hi-Land Farmers’ MPC operations. – MEM