On June 13, 2025, the Cooperative Development Authority – Cordillera Administrative Region Extension Office (CDA-CAR EO) successfully conducted an online Roadshow Workshop Orientation on Financial Performance Standards (PESOS), targeting cooperatives engaged in savings and credit operations. The event drew participation from 93 individuals representing 51 cooperatives across various regions, demonstrating the sector’s strong commitment to financial literacy and regulatory compliance.

Ms. Felicidad R. Cenon, PhD., Officer-in-Charge Regional Director of CDA-CAR EO, in her welcome remarks emphasized the importance of continuous learning and capacity-building in the cooperative sector. She underscored that strengthening the competencies of cooperative officers and members is key to sustaining the growth and success of cooperatives in the region.

This message was reinforced by Assistant Secretary Luz H. Yringco, who delivered the official opening remarks. She highlighted the vital role that financial standards play in ensuring the long-term sustainability of cooperatives. ASec. Yringco introduced the PESOS — a set of prudential standards designed to help cooperatives assess and improve their financial health.

The orientation was led by Mr. Ernan Palabyab, an experienced cooperative leader and trainer, who guided participants through a comprehensive discussion on financial performance standards.

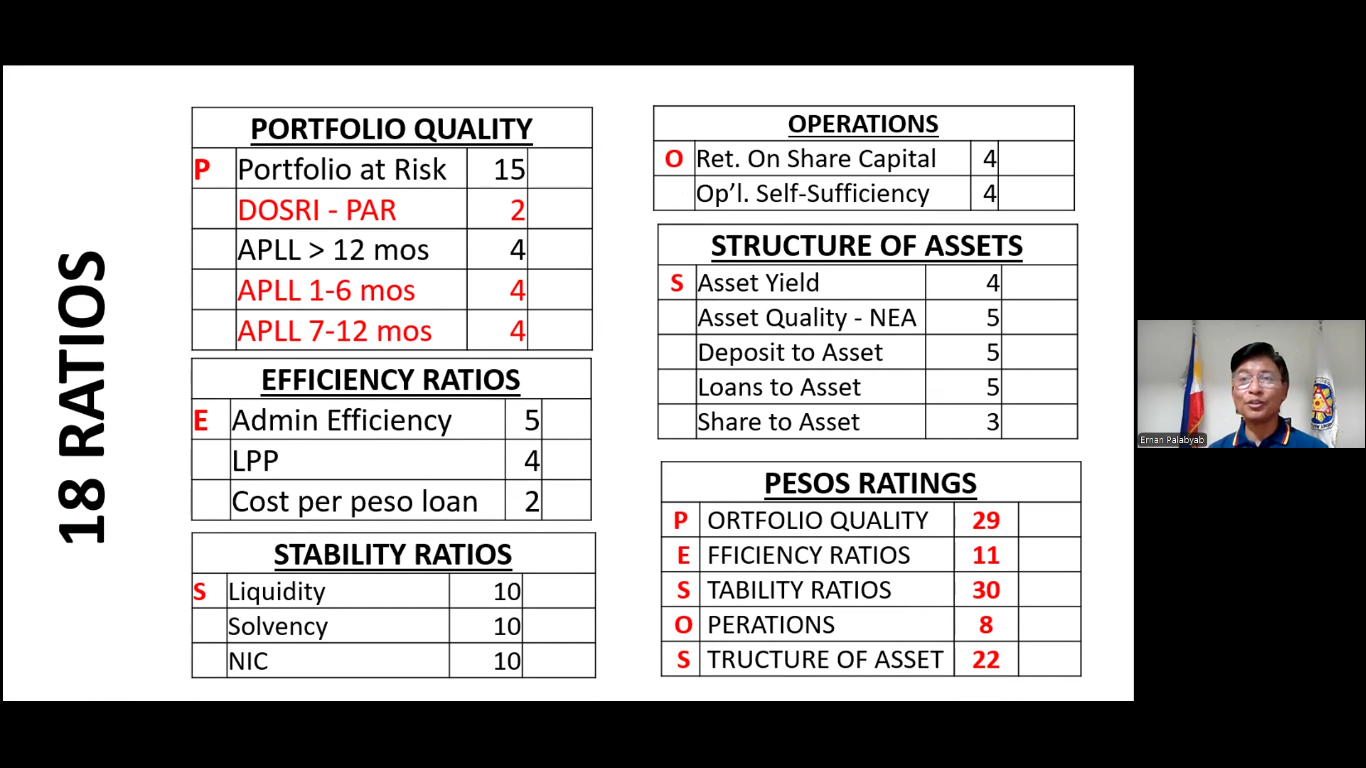

He further explained that the standards are applied differently depending on the size of the cooperative—there are separate criteria for micro, small, medium, and large cooperatives. Essential financial metrics such as liquidity, solvency, and institutional capital formation were detailed, equipping participants with the knowledge to apply these tools in assessing their cooperative’s financial position.

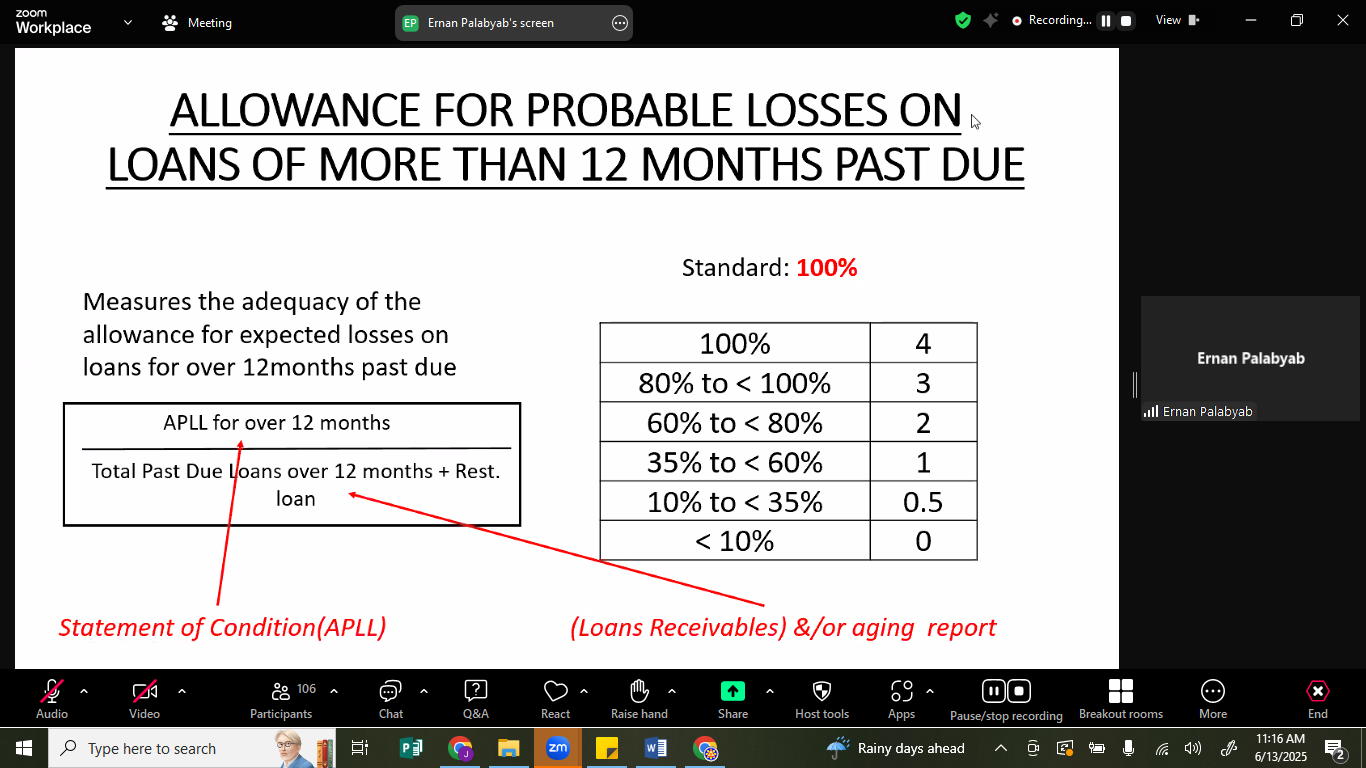

An important topic covered during the session was the management of allowances for loan losses. Mr. Palabyab emphasized that insufficient loan loss allowances can distort a cooperative’s financial statements, leading to overstated assets and income, which could ultimately result in balance sheet insolvency.

He discussed the process of charging off uncollectible loans, cooperative restructuring policies, and the necessity of persistent collection efforts even after loans are charged off. These practices, according to Mr. Palabyab, are fundamental to safeguarding the financial health of lending cooperatives.

The orientation also delved into important financial ratios that cooperatives must monitor regularly. In addition, participants were guided on understanding solvency ratios and the role of institutional capital in strengthening the financial base of cooperatives. Mr. Palabyab highlighted the importance of not only having reserves but also properly accounting for and reporting these funds to demonstrate transparency and good governance.

The Cooperative Financial Standards Orientation provided cooperative leaders and members with a clearer understanding of how to assess and maintain their financial health using the PESOS framework. With a deeper grasp of financial performance standards, cooperatives can build stronger foundations, safeguard member investments, and contribute meaningfully to their communities’ development.

By equipping cooperatives with these essential financial tools, the orientation reaffirmed the CDA’s commitment to building sustainable, resilient, and empowered cooperatives across the country.