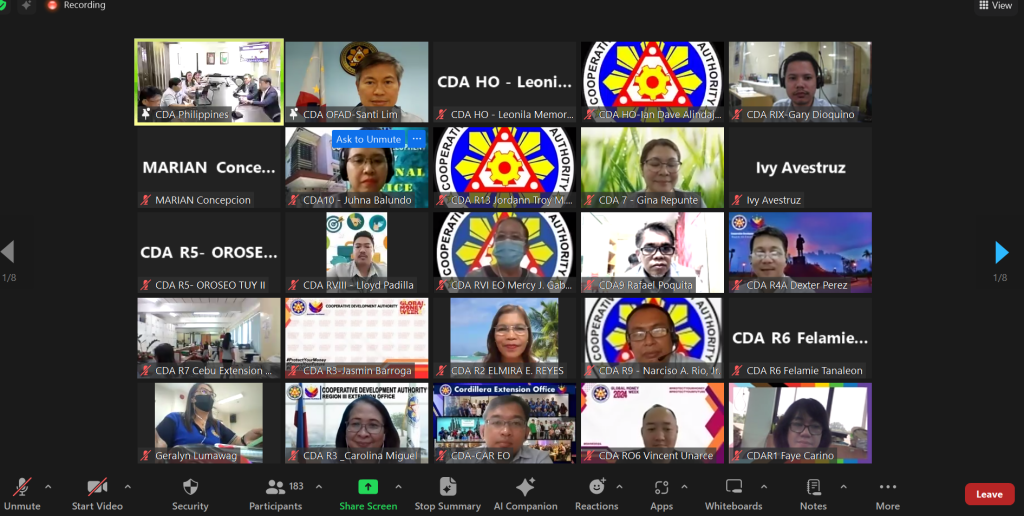

As the Authority sets its sight on year 2025 when RA 11765 or the “Financial Products and Consumer Protection Act (FCPA)” shall be fully implemented, 185 CDA personnel from the Regional Extension Offices were oriented on the salient features of RA 11765 and its IRR promulgated through Memorandum Circular No. 2024-13. The orientation was conducted on March 25, 2024 via Zoom video conferencing platform.

The FCPA, signed into law on May 6, 2022, provides protection to consumers of financial products and services against unreasonable and disadvantageous terms and conditions by strengthening the powers of financial regulators, ascertaining the duties and responsibilities of financial service providers, and solidifying financial consumers’ rights and remedies.

In his presentation of the activity rationale, Mr. Joselito O. Hallazgo, Acting Director of the CSF Service mentioned that the focus of the orientation was on the important roles of the personnel in the implementation of the said law – addressing consumer grievances, conduct of inspection, supervision and monitoring and guiding the cooperatives on institutionalizing financial consumer protection as an integral component of their cooperative governance, culture and risk management.

Cognizant of these important roles, both Asec. Santiago S. Lim, the CDA Administrator and Asec. Luz H. Yringco, the Head of the Finance Cluster, in their messages to the participants, underscored the value of being adequately prepared for the job ahead, that is having, the right tools and understanding of the law. Hence, they encouraged them to give their full attention to the orientation. They also conveyed their appreciation to the participants for taking on their new tasks.

On the first part of the orientation, Ms. Jo Ann C. Gamboa, Chief of the Inspection and Examination, highlighted the powers of the CDA granted by the law such as setting of its own standards and rules, conduct of onsite and offsite inspection, supervision and monitoring of CDA-Regulated Entities or the cooperatives offering financial products and services. Given these powers, Ms. Gamboa presented to the participants the duties and responsibilities required by MC No. 2023-14 to be undertaken by the CDAREs. The compliance by the CDAREs with these requirements shall be subject of the inspection of to be conducted by the CDA personnel on the second half of year 2025.

Atty. Ma. Lourdes P. Pacao, Deputy Administrator of the CSF Service, on the second part of the orientation, presented the framework in the handling of complaints before the Authority. She mentioned that as a financial regulator, the Authority is tasked to provide different ways in handling consumer redress and complaints such as mediation, conciliation and other alternative dispute resolution which the financial consumers may avail of prior to adjudication. She added that in case adjudication ensues, the Authority, through the Adjudication Division, has the power to adjudicate actions arising out of or in connection with financial consumer transactions with cooperatives or violations or implementation of the provisions of R.A. No. 11765 not resolved at the cooperative level as other cases falling within the jurisdiction of the Authority as provided in the CDA Charter. With this, Atty. Pacao assured the personnel who will be assigned to handle complaints and grievances of the financial consumers that they will be given training on mediation and conciliation.

The Authority shall remain steadfast with its efforts in ensuring that all mechanisms to afford protection to financial consumers are undertaken which includes continuously capacitating personnel involved in the implementation of RA 11765.