Committed to providing technical assistance to registered cooperatives, the Fiscal Incentives Review Board (FIRB) Secretariat, in partnership with the Cooperative Development Authority (CDA), conducted 11 onsite workshops for around 1,400 cooperative-participants nationwide from August 2023 to March 2024.

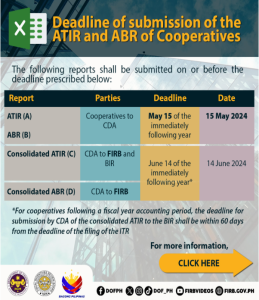

Ensuring that the submission of reportorial requirements under the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act are easily and efficiently complied with, the FIRB Secretariat and the CDA extensively conducted interactive onsite workshops on how to fill out the simplified templates on the Annual Tax Incentives Report (ATIR) and Annual Benefits Report (ABR) of cooperatives.

The workshop series was attended by representatives from the different regional CDA offices, cooperative development officers of local government units, as well as representatives from the primary and secondary cooperatives around the country.

Through continuous consultations, the FIRB Secretariat was able to streamline the ATIR and ABR forms to ensure compliance and simplify report submissions. Workshop participants expressed unanimous praise for the user-friendly forms and found the templates easy to prepare and accomplish.

Apart from the hands-on demonstration on how to fill out the templates, the FIRB Secretariat also discussed the salient features of the Department of Finance (DOF) and Department of Trade and Industry (DTI) Joint Administrative Order (JAO) No. 001-2023, which provides for the guidelines to implement Sections 305 to 308 of Chapter V (Tax Incentives Management and Transparency) of the Tax Code, as amended by the CREATE Act.

Aligned with its policymaking and oversight functions, the FIRB, through its Secretariat, shall systematically collect and store all tax incentives and benefits data from the DOF, CDA, and registered cooperatives to provide objective data on the impact evaluation of tax incentives to the Philippine economy.

With cooperatives playing a crucial role in nation-building and economic development in pursuing a Bagong Pilipinas, the FIRB-led workshops support cooperatives in providing clear and complete data submissions of tax expenditures and benefits, which shall aid in fiscal policy making.

DOF-DTI Joint Administrative Order No. 001-2023

FIRB Advisory 001-2024

FIRB Advisory 019-2023

FIRB FORM 30003AS: Annual Tax Incentives Report (ATIR) and Annual Benefits Report (ABR) of Cooperatives V2.2