As the ongoing campaign to strengthen the implementation of the Republic Act 9510, otherwise known as the Credit Information System Act (CISA) broadens nationwide cooperatives engaged in credit services are empowered to heighten its compliance.

In a proactive move to increase compliance and empower cooperatives with a better understanding of the particular law, the Cooperative Development Authority under the guidance of the Head of the Finance Cooperatives Cluster, Assistant Secretary Luz H. Yringco, and CDA RO VIII Regional Director Venus M. Jornales, in partnership with the Eastern Visayas Cooperative Federation (EVCF), Credit Information Corporation (CIC), and in coordination with the Local Government Unit of Baybay through Mayor Jose Carlos L. Cari spearheaded the conduct of an in-person Orientation-Workshop on Republic Act 9510, also known as the Credit Information Systems Act (CISA). Held on January 18-19, 2024, in the province of Leyte, at the Baybay City Complex, Baybay City, a total of 248 cooperative members from the different cooperatives engaged in credit services in Region VIII participated in the fruitful two-day activity.

The Orientation-Workshop started off with RD Venus Jornales’ uplifting message through Mr. Mark B. Mapanao, Senior CDS of the CDA RO VIII’s Supervision and Examination Section, and a warm welcome by Atty. Florante Cayunda Jr., City Administrator of Baybay City to represent Mayor Cari. Also present during the Opening Ceremony were the City Councilors of Baybay City namely, Hon. Dominic Murillo, Hon. Jorge Rebucas, Hon. Felimon Avila, Hon. Romulo Alcala, and SK Federation President Hon. Shannen Vidal. Likewise, Asec. Yringco expressed her gratitude to the Local Government Unit of Baybay for the continued support with the programs and activities intended for the advantage of the

cooperatives as well as to the CIC for serving as resource speakers.

Key topics covered during the first day of the activity included the Orientation on Credit Information Systems Act and dispute resolution by Atty. Philip Gerald Fulgueras, Attorney III of Credit Information Corporation (CIC). He emphasized the importance of compliance and submission of cooperatives as submitting entities, as well as the penalties that they may incur through their non-compliance with the law. Another highlight of the event was the practical session or the workshop by Ms. Haselle Meh L. Menia, Data Controller IV of CIC, demonstrating the procedures for the preparation, encoding, and submission of basic

Key topics covered during the first day of the activity included the Orientation on Credit Information Systems Act and dispute resolution by Atty. Philip Gerald Fulgueras, Attorney III of Credit Information Corporation (CIC). He emphasized the importance of compliance and submission of cooperatives as submitting entities, as well as the penalties that they may incur through their non-compliance with the law. Another highlight of the event was the practical session or the workshop by Ms. Haselle Meh L. Menia, Data Controller IV of CIC, demonstrating the procedures for the preparation, encoding, and submission of basic

credit data reports as well as on how to read error reports.

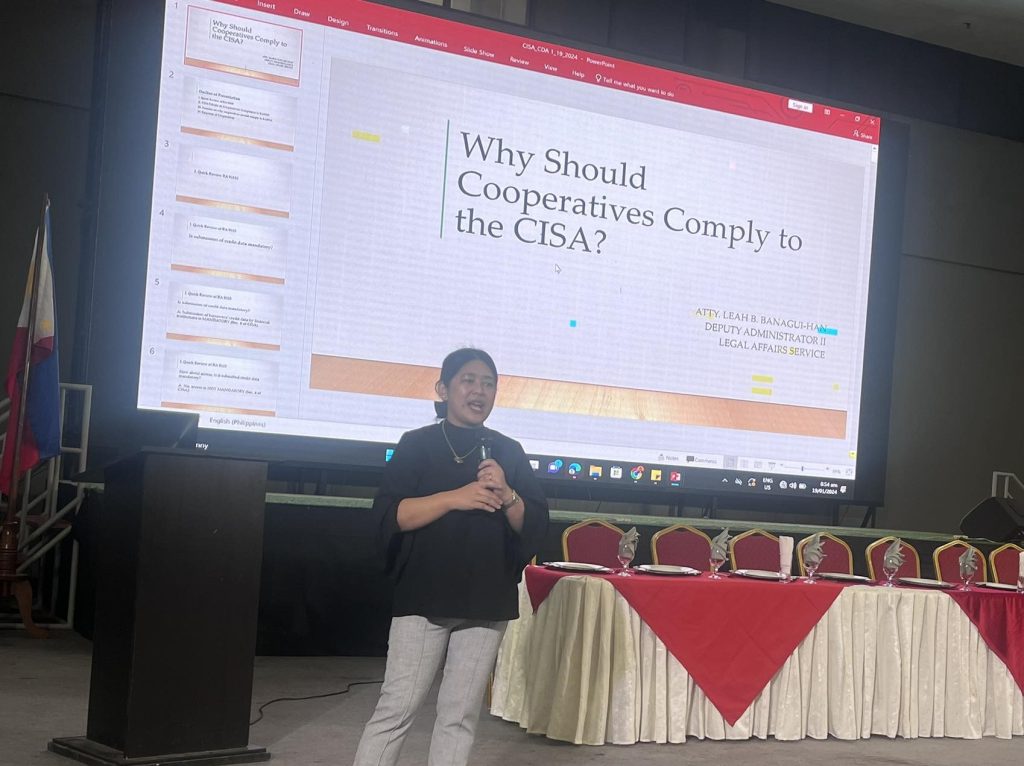

On the second day, Atty. Leah B. Banagui-Han, Deputy Administrator of CDA LAS, discussed the Salient Features of RA 11364- An Act Reorganizing and Strengthening the Cooperative Development Authority, Repealing for the Purpose Republic Act No. 6939, Creating The Cooperative Development Authority. DA Leah featured the Adjudication function of CDA as a new major function of the Authority being a Quasi-judicial body, and the process/ flow on resolving conflict.

She also had a recap on the salient features of RA 9510. The second day was also allotted for the continuation of the workshop for the cooperatives to be well versed on the procedure of the submission of basic credit data reports. Ms. Maria Prexcilla Ypil and Ms. Jocelyn Ibanez, both from CIC, were also present to answer queries and assist the cooperatives in the hands-on activity.

She also had a recap on the salient features of RA 9510. The second day was also allotted for the continuation of the workshop for the cooperatives to be well versed on the procedure of the submission of basic credit data reports. Ms. Maria Prexcilla Ypil and Ms. Jocelyn Ibanez, both from CIC, were also present to answer queries and assist the cooperatives in the hands-on activity.

The Orientation-Workshop concluded with words of encouragement from Asec. Luz H. Yringco, emboldening cooperatives to comply with the CISA law and assuring them that the Cooperative Development Authority is not adversarial, rather a strong partner in the development of the cooperatives.

The Credit Information System Act, enacted in 2008, plays a crucial role in fostering a healthy credit environment by regulating the collection and dissemination of credit information. The conduct of this activity is a huge help for cooperatives engaged in credit services to be equipped with the required knowledge of the statute and its potential impact on their financial landscape. Further, it is the goal of the Authority following the conduct of the Workshop, to achieve an increase in compliance of the cooperatives.